News

Fnality International, a London, UK-based provider of DLT-based wholesale payment systems, raised £77M in Series B funding.

The round was led by Goldman Sachs and BNP Paribas, with participation from DTCC, Euroclear, Nomura and WisdomTree. There were also additional investments from Series A investors Banco Santander, BNY Mellon, Barclays, CIBC, Commerzbank, ING, Lloyds Banking Group, Nasdaq Ventures, State Street, Sumitomo Mitsui Banking Corporation, and UBS. It followed a follows Series A of £55M in June 2019.

To read more, click here.

UK-founded crypto exchange Blockchain.com has closed a $110m (£88m) investment round that has halved the valuation of the unicorn.

The Series E round, which was led by Kingsway Capital, has valued the company at less than $7bn, a sharp drop compared to the $14bn valuation the company received following a funding round from March of 2022, first reported by Bloomberg.

Other participants in the round included Lakestar, Lightspeed Venture Partners and Coinbase Ventures.

To read more, click here.

Imprint, a NYC-based provider of co-branded credit cards for brands, raised $75M in Series B funding.

The round was led by Ribbit Capital, with participation from Thrive Capital, Kleiner Perkins, and Moore Specialty Credit. The company intends to use the funds to further enhance its balance sheet and empower the scale of its existing and new programs.

Led by CEO Daragh Murphy, Imprint is a co-branded credit card issuer that provides brands with co-branded credit card programs that increase customer loyalty. Its digital cardholder experience and designed technology stack deliver bespoke programs and customized rewards for each brand. Imprint tailors the level of program integration to each brand’s needs, and can launch programs in as little as 3 months.

To read more, click here.

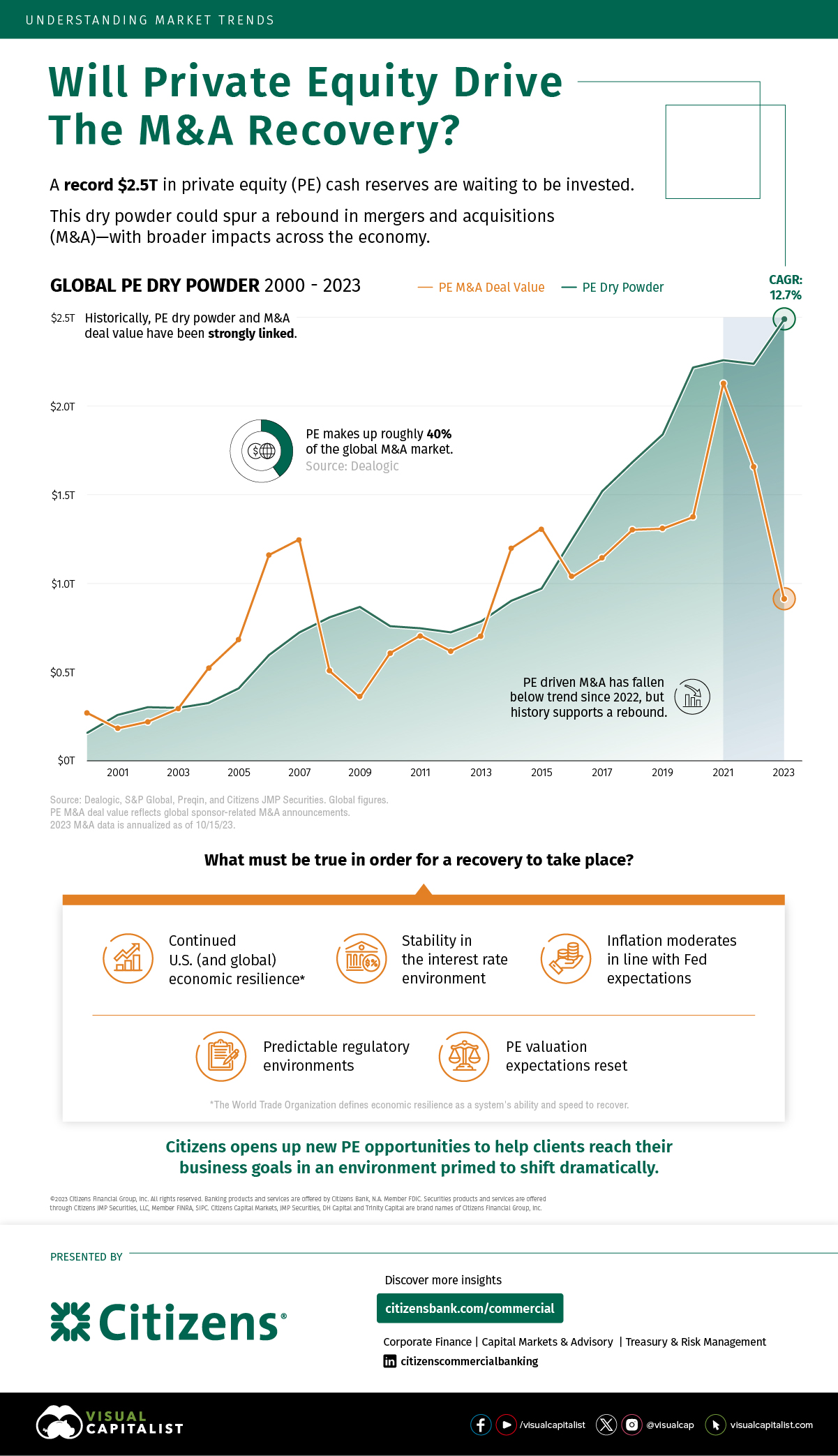

Will Private Equity drive the M&A recovery?

Will Private Equity drive the M&A recovery?

A record $2.5tr in Private Equity (PE) cash reserves are waiting to be invested. This dry powder could spur a rebound in M&A with broader impacts across the economy. PE firms deploy this cash to acquire private companies ripe for growth, with the goal of driving higher valuations. Historically, a higher store of cash has been strongly linked to greater PE deal activity.

Since 2000, global PE cash reserves—also known as dry powder—have grown at a 12.7% compound annual growth rate. This capital has been a key source of growth and funding for companies, with PE making up roughly 40% of the global M&A market.

To read more, click here.

Databricks, a San Francisco, CA-based data and AI company, raised an undisclosed amount in Series I funding.

Existing investors Amazon Web Services (AWS), CapitalG, and Microsoft, along with new investors AT&T Ventures, Qatar Investment Authority (QIA), and Sanabil Investments, participated in the funding round, which put the company at a $43B post-money valuation. They joined previously announced investors participating in the Series I funding, including Andreessen Horowitz, Baillie Gifford, Capital One Ventures, ClearBridge Investments, funds and accounts managed by Counterpoint Global (Morgan Stanley), Fidelity Management & Research Company, Franklin Templeton, Gaingels, Ghisallo Capital Management, GIC, NVIDIA, Octahedron Capital, Ontario Teachers’ Pension Plan, funds and accounts advised by T. Rowe Price Associates, Inc. and Tiger Global.

To read more, click here.

BlackRock wants to create an ETF that holds Ethereum's ether (ETH), a plan that deepens the world's largest asset manager's commitment to cryptocurrencies.

Following the news, ETH's price surged to its highest level of the day near $2,100, up about 3% versus just before the filing came out. It later gave back about half that gain, though it remains up about 9% versus 24 hours earlier.

The company's plan was revealed in a filing by Nasdaq, the U.S. exchange where BlackRock will seek to list the product – which will need regulatory approval. Earlier Thursday, it emerged that the corporate entity "iShares Ethereum Trust" had been registered in the state of Delaware; iShares is the name of BlackRock's ETF division.

To read more, click here.

UK-based Ooodles raises a $12 million funding round, led by Paris-based asset manager, Smart Lenders Asset Management (SLAM). Founded in 2021 by Leonardo Poggiali, a veteran of Sony Mobile and Jawbone, Ooodles leases high-end laptops, phones, and other such hardware on a monthly, Pay-As-You-Go subscription model.

To read more, click here.

LHL, a UK based company, is proud to announce a significant capital commitment of £20 million from Nimbus Capital, a private investment group that specializes in financing in transformational change and dynamic growth. Nimbus Capital manages a diverse portfolio of investment vehicles, providing flexible and innovative funding solutions to growing businesses worldwide.

To read more, click here.

Byju's is in talks to sell its kids' digital reading platform for $400 million to Joffre Capital Ltd, in order to raise funds to pay down a disputed $1.2 billion term loan. Other bidders, including Duolingo Inc, have also expressed interest in buying the platform.

To read more, click here.

Huel, the leading sustainable nutrition brand, is pleased to announce an investment by Morgan Stanley Investment Management’s (MSIM) 1GT climate private equity strategy which will see the two parties work in close collaboration. Huel has raised £82.5m from Morgan Stanley.

Huel, which is the second investment made by 1GT, has been hailed as a best-in-class addition to its portfolio given the strength of Huel’s sustainability commitments and position as a nutritionally complete food. 1GT aims to provide insight and expertise from across the Morgan Stanley business to enhance Huel’s sustainability agenda and capture growth opportunities in the United States and globally.

To read more, click here.